P&P Capital Growth Fund One

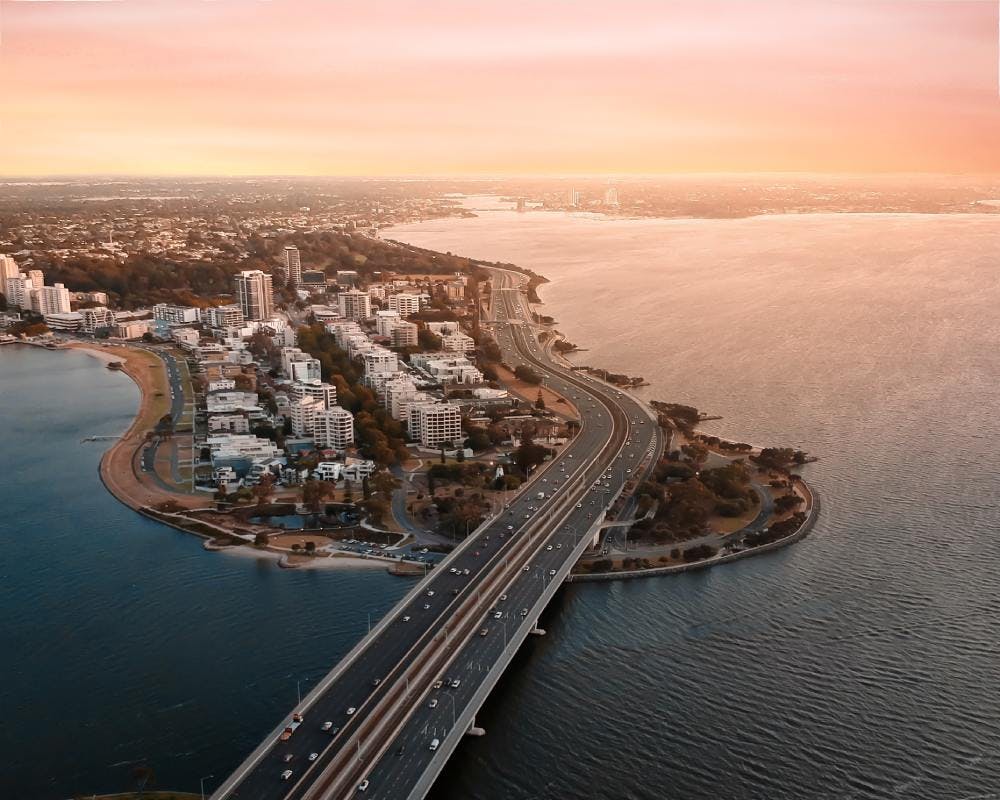

Capitalising on a once-in-a-decade residential market.

The P&P Capital Growth Fund One has fully subscribed.

Properties & Pathways’ first residential-focused fund—The P&P Capital Growth Fund One (CGF 1)—opened in December 2021, fully subscribing within hours of launch. The fund’s goal is to capitalise on Perth’s once-in-a-decade residential property market, targeting established assets with value-add potential.

The success of CGF 1 led to the launch of CGF 2 in February 2024.

50.00%-62.50%

Total Return

12.50% p.a.

IRR Hurdle Rate

4-5 years

Investment Timeline

$4,100,000

Equity Required

Investment Highlights

Total Return: 50.00-62.50*%

Annual Cash Flow: 0%

IRR Hurdle Rate: 12.50%

Assets: 8 targeted residential properties

Investment Timeline: 4-5 years

Availability: Max. 16 investor slots

*Return stated is NET i.e. after all costs, fees, charges, etc.

“We’re at a point in time; a once-in-a-decade moment to capitalise on a residential market ready to burst.”

Cal Doggett

Managing Director, Properties & Pathways

Investment Strategy

- The Trust will acquire at least 8 separate, land-rich residential dwellings, the majority of which will be capable of subdivision and all which benefit from 30 established selection criteria.

- Each property will be acquired with thorough analysis of the capital growth history of the suburb and market analysis of comparable sales/rental rates in the relevant suburb.

- Each acquisition focuses on robust property fundamentals which drive relevance and high buyer demand.

- We believe the attractive purchase price and land-rich nature of each property will protect the investment over a 4-5 year horizon whilst delivering robust capital growth.

Information Memorandum

Investment Updates

Subscribe to our newsletter

The latest news, articles, and resources, sent to your inbox weekly.

Past performance is not indicative of future returns. Any information provided on this website has not considered the objectives, financial situation or needs of any investor; investors should consider whether it is appropriate to them to partake in a commercial property investment prior to investing, in light of their objectives, financial situation or needs. Every investor should obtain and consider the investment’s Information Memorandum before making a decision in relation to the investment.