Economy

Australia’s rapid population growth and its impact on real estate

Published

14 May, 2024

You’re not alone if you’re noticing more car and foot traffic on Australia’s city roads and pathways. Experts have revealed Australia’s population increased by 634,000 people in the year ending June 2023, showing a huge pip to the two-year declining trend caused by the pandemic.

The country’s 5-year annual average growth rate of 316,000 people still sits below the 20-year average (of approx 350,000). We’ve already mentioned COVID-19, and that is very much the catalyst for the shortfall. But considering a near-doubling of the 5-year average in 2023 alone, a few questions must be asked:

Where is this population growth occurring? What is causing the massive increase in new arrivals to Australia? And for us property investors, what impact is it having on our dwelling values?

Where is the growth happening?

Interestingly, most new arrivals have headed to the outskirts of capital cities and regional areas and towns. Leading the charge was the region of Wyndham in Melbourne, seeing a 41,000-person increase in the five years to June 30, 2023, while Blacktown (north of Sydney) saw 36,000 additions during the same period, the highest five-year population growth in any Australian city.

In the west, Perth’s northeast and northwest corridors saw notable increases, with 16,959 and 14,885 respective new arrivals.

There’s a distinctive quality that regional areas and fringe suburbs have that inner city locales don’t. And it’s this reason that they are experiencing the largest bouts of population growth across the nation…

Housing affordability: the fuel for population growth

In the 12 months to March 2024, over 60 per cent of SA3 regions—areas typically on city outskirts or regional areas—recorded median home sale prices below their broader city or regional area medians. When they can, people move to where housing and living costs are cheaper. And with a housing affordability crisis plaguing most states’ capital cities, it’s no wonder that migrants are headed to quieter, less populated areas.

Subsequently, we would expect these regions would likely see increased property price growth, given the attractiveness of cheaper living conditions and stronger population growth. A higher demand for housing of course leads to higher prices for established dwellings.

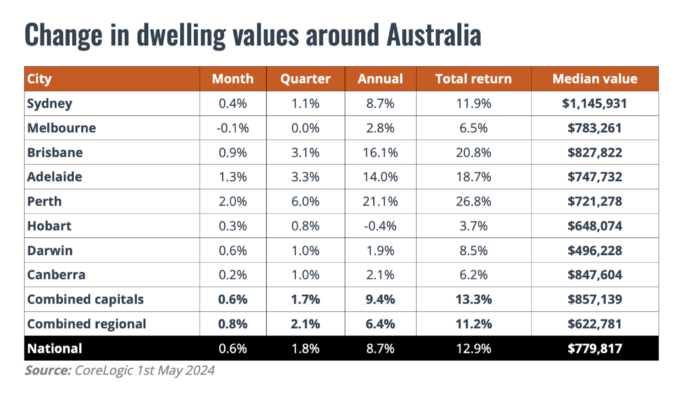

This is what we’re seeing in the Perth property market. Even in Perth’s inner city precincts, housing is incredibly affordable in comparison to the east coast. A Perth median house price of $721,278 (as of May 2024) pales in comparison to Sydney’s $1,145,921, and even sits below the nation’s median of $779,817.

What’s ahead for Australia’s population growth?

According to realestate.com.au, Australia’s population is tipped to grow 1.2 per cent to 1.7 per cent each year, hitting between 29 million and 32 million by June 2032.

The government—whose past infrastructure and housing planning has been questionable—is now on the frontfoot to solve the housing crisis. The federal government aims to build 1.2 million homes over the next five years. Unfortunately, should it wish to meet its goal, the rate of construction is already falling short.

Across the country, the need for housing isn’t decreasing anytime soon, nor will we see a magical boost in the supply of established homes. The option for many is regional living, and as we’ve seen this is not only a popular idea, but potentially a prosperous one for those investing in areas of expected future population growth—and subsequent property value growth.

Enjoy this article? Subscribe to our newsletter for up-to-date news and unique views on Australia’s property market and economy. It’s delivered straight to your inbox every month, and you can unsubscribe anytime.