Insights

How did Australia’s property market turn out after the last few booms?

Published

28 November, 2024

If you’ve had skin in the game, the last three years in the country’s property market has been very exciting. Despite some precincts seeing negative year-on-year growth since 2023, values across the country have skyrocketed since the pandemic. Many markets are forecasted to continue this run of exceptional value appreciation into 2025, especially as expectations are for the Reserve Bank to soon drop interest rates.

But at some point, one has to ask, how long will this carry on for? And that’s a tough, if not impossible, question to answer with pure accuracy. If you want to better understand what might come after a boom period in your local property market, it can be interesting to look in the rearview mirror.

Understanding how the market behaved after the last few booms can provide valuable lessons and insights for navigating future cycles—but of course history has no guarantee of repeating, in which case, review with caution.

So, even for the sake of satisfying our curiosity, how did Australia’s property market turn out after the last few booms?

The aftermath of Australia’s most recent property booms

The 1990s property boom

Era: Early-mid 1990s

National median property price: $184,600 (1990)

Buying property in the late 80s meant you were holding on to a cash cow going into the final decade of the millennium. Despite the “recession we had to have,” which ensured economic reforms that strengthened the overall economy in later years, the early to mid-1990s saw a significant property boom across the nation.

Property values had increased by approximately 20 per cent by the end of the boom. Interest rates peaked at 17 per cent in the early 1990s, meaning home ownership became out of reach for many. But the cost of paying for a mortgage then halved in the years that followed.

So, driven by a combination of low interest rates, deregulation of financial markets in the 1980s and rising consumer confidence following the economic recovery from the early 1990s recession, the property market was hot. East coast cities like Sydney and Melbourne saw noteable growth, while the west coast saw more modest gains due to slower economic activity in Perth at the time.

Post-boom downturn

But all good things come to an end.

The boom was followed by a period of stagnation in the late 1990s. In Sydney and Melbourne, property prices plateaued, with little to no real growth for several years as affordability constraints caught up with buyers. Perth’s market also stagnated, reflecting the broader economic conditions of Western Australia, which had not yet entered its mining boom era.

Overall, the nominal reduction in property values is agreed to have been at about the 10 per cent mark, after a period where annual growth rates of 20 per cent weren’t uncommon.

The 2000s mining boom

Era: 2003-2007

National median property price: $453,700 (2007)

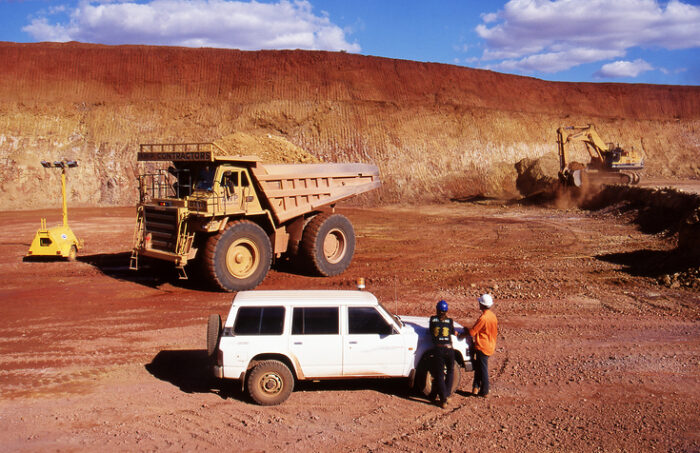

In the early to mid 2000s, the mining industry grabbed Australia’s property market by the hand, together forging a boom period that many would still remember as a golden age for investment.

The country experienced a rapid rise in property prices due to strong demand for housing driven by a surge in mining activity. Jobs, population and wages all increased, meaning realtors’ phones were ringing off the hook. This boom spilled over into other regions, but the effects were most pronounced in mining-focused states, like WA and QLD.

Post-boom downturn

But when the mining sector slowed in 2008 following the Global Financial Crisis (GFC), property prices in Western Australia softened significantly. Perth’s market stagnated, with declines in both property values and rental yields. Those speculative investments in mining town residential property quickly went south, with some investors sadly ending up with mortgages far larger than the values of their assets.

Meanwhile, many east coast precincts remained relatively insulated due to diversified economies and a rebound fueled by record-low interest rates.

The post-GFC boom

Era: 2012-2017

National median property price: $813,024 (2017)

The aftermath of the GFC saw record-low interest rates, relaxed lending policies, and strong population growth, fueling a property boom led by Sydney and Melbourne. Prices in these cities doubled in some areas between 2012 and 2017.

That said, housing prices in Perth during much of this period tumbled. The WA mining boom started in 2009 and ended in 2014. Mum and Dad investors were putting their savings into regional towns, with the promise of exceptional capital gains from mining towns that were created seemingly from thin air. Demand for those speculative properties was so rife that many needed to throw their hat in the ring via a ballot system to have any hope of joining the fun.

Post-boom downturn

In 2018, tighter lending restrictions from the Australian Prudential Regulation Authority (APRA) and the Royal Commission into banking led to a softening market. Median house prices in Sydney and Melbourne dropped by around 10 per cent to 15 per cent over two years.

Some regional areas and major precincts—such as Perth—were already subdued, and simply experienced modest growth or stagnation during this time. Somewhere in this period saw the start of Perth’s decade long property slump, where values barely budged until someone sneezed in China and set off a chain of events that would never be forgotten.

The pandemic boom

Era: 2020-2024 (or continued, in some regions)

National median property price: $802,357 (2024)

COVID-19 sparked an unprecedented property boom, driven by record-low interest rates, government incentives (like the HomeBuilder program to support new residential development), and a surge in demand for lifestyle properties.

Prices skyrocketed nationwide, with regional areas such as coastal NSW, Queensland and parts of Western Australia seeing a significant influx of buyers.

As of this writing, Perth continues to dominate the country’s market, with double digit annual growth and performance that outstrips nearly every other capital city (as well as the national average).

Post-boom downturn

From mid-2022, rising interest rates quickly cooled the market in Sydney and Melbourne, which began to see negative growth in 2023 and then price reductions of up to 10 per cent 15 per cent in 2024.

But that’s not the case for the entire country…

Perth has shown that it runs its own race, due to an influx of migrants, an extreme shortage of housing, ongoing demand in the mining sector and relatively affordable prices in comparison to the rest of the country.

We’re writing this at the tail-end of 2024, and while we don’t have a crystal ball, our insights tell us that 2025 will be another big year for the west’s property market.

Beyond that? We wouldn’t bet our house on things being as rosy. But more on that in a future blog post.

Want more investment info like this? Subscribe to our monthly newsletter and we’ll deliver expert written news and views direct to your inbox. We’ll never spam you and you can unsubscribe anytime.