Insights

How much money do investors lose every year?

Published

03 May, 2021

You never hear about the losses – only the gains. That’s what my dad used to tell me when we talked about punters and gamblers and speculators. They’d boast about their big wins, not their formidable losses. And it makes sense. Why would anyone – any gambler or punter – talk about their losses when the wins are so much more exciting?

Of course, all investments fluctuate and all markets ride cycles. So, it’s not prudent to say that share investors lose X while property investors lose Y. But we can perhaps see the trends over, say, the last decade and see which investment classes (even commercial property investment) are the most stable for those merely wanting a passive income.

Which brings me to my next point. Today, we’re only talking about yield – regular income from an investment – not capital growth or total returns. Let’s dive in.

How much do investors lose on the stock market?

Negative stock market values occur about once every four years. So, those investing for the long-term and in stocks offering stable yields at relatively low risk rarely expect to see negative yields from their investment.

But it’s those who don’t know what they’re doing who lose on the stock market. And a lot of the time, they’re the people who are after quick wins: high returns in a short amount of time.

Let’s look at share investing during COVID-19.

One of our most popular blog posts we published last year was Why buying shares during COVID-19 is a bad idea.

Two points stood out in our research:

Firstly:

“In the 40 days after February 24, 2020, ASIC recorded 4,675 new ASX investors per day. That’s a whopping total of 140,241 new share investors getting in line for COVID-19 stock bargains during that 40-day period. New accounts made up 21.4 per cent of all active ASX accounts.”

This paints a pretty apparent picture. Those with money to burn probably heard from a friend that their friend had thrown money at the stock market due to the lingering low values caused by the pandemic shutting or slowing down businesses. And they raced to open an ASX account to take advantage.

Sure, many people made a lot of money. But what about the average punter? The first-timer with no experience and no guidance?

This leads to the blog post’s second point:

“On more than two-thirds of the days on which retail investors were net buyers, the share prices of the stocks they invested in declined the next day.”

When COVID-19 hit Australia early in 2020, two of every three first-time investors lost money the day after they invested their money on the ASX.

It’s said that up to 90 per cent of people lose money on stock markets. I’d say that the majority of those people are traders – those looking to find those quick wins, or arbitrage opportunities – and the other 10 per cent are most likely investors.

Investors have the patience to see their money gain value over the long-term, while achieving a positive cash flow on their investment as a result.

We like positive cash flow. So do our investors. And that’s what our investments offer. Learn more by checking out our current investment opportunities.

How many investors lose investing in cryptocurrency?

If you think the stock market is volatile, check out the performance of cryptocurrency over the last few years.

For those new to it, cryptocurrency is a digital form of currency, designed for users to navigate instant payments and transactions without the need of banks and without the influence of governments.

Few cryptocurrencies pay a dividend, so here we’re just going to look at the value of one of the most popular cryptocurrencies: Bitcoin.

Around 106 million people are in possession of Bitcoin (typically only a portion of a Bitcoin, as one Bitcoin unit is worth tens of thousands of dollars), and it’s fair to see a large number of them are involved for speculative purposes only.

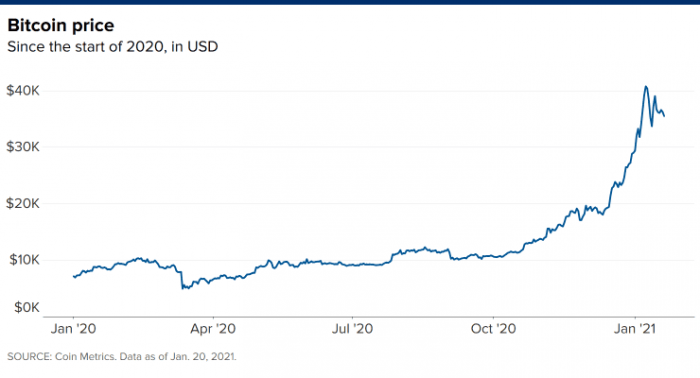

CNBC reported the first quarter Bitcoin results for 2021, and I felt like I was on a rollercoaster just reading it:

“The asset hit a record high of $41,973 on Jan. 12, according to data from Coin Metrics, but just days later fell about 15%, wiping as much as $200 billion from the cryptocurrency market in just 24 hours.

“The next week, it regained some of its losses, surging to near $40,000 before reversing course yet again. On Thursday [Jan. 21], the cryptocurrency slipped about 8%, bringing the asset’s two-day losses to more than 10%. In addition, the price of bitcoin fell below $32,000 for the first time since Jan. 11.

“The slump wiped another $100 billion from the total cryptocurrency market in 48 hours.”

Even the crypto experts say, only invest what you’re prepared to lose.

It’s hard to find a more speculative investment these days than cryptocurrency. Well, except maybe slot machines.

How many investors lose from residential property investment?

Property is known to hold its value well. While we can’t say it’s impossible to lose while investing in real estate, there are many reasons investors feel comfortable that the future value of their residential investment will not drop. Investors have their property’s underlying land value to thank for that.

But what about income from residential property? How much have investors lost over the years in residential yields?

Well, residential property typically provides investors with annual yields of between 1 per cent and 3 per cent, perhaps higher during a property boom or with a strong leasing market.

But taking into account expenses for a residential property, including fees for property management (if you’re hiring someone to look after the premises) and interest charges from your mortgage, residential property investors aren’t left with all that much to play with at the end of the year.

That means annual expenses on a $1 million property must be below the $30,000 in gross rent you receive each year (assuming the property is achieving a gross yield of 3 per cent). The interest on the mortgage alone, say $32,000 per year (an $800,000 loan at a rate of 4 per cent) already exceeds rent. That’s already a net yield of negative 0.2 per cent. And we haven’t even considered regular operating expenses.

Sure, residential property is a brilliant vehicle for capital growth. But for yield, for those looking to earn a passive income, there’s really nothing spectacular about residential property investment.

How much do investors lose in commercial real estate?

We don’t have a figure for this and that’s perhaps because commercial property losers are hard to find. Especially if investors put their money with a renowned commercial property investment firm.

That’s because commercial property is renowned for its strong rental yields.

Commercial property will see investors receive an annual yield of anywhere between 5 per cent and 7 per cent, and sometimes even higher if the investment is chosen well.

One major reason commercial property yields are so much higher than residential returns is because of the underlying lease agreements. Commercial tenants tend to occupy commercial assets for far longer, for up to ten years sometimes, and pay a much higher premium to do so than your average tenant in your average house on the street. After all, commercial tenants are earning an income while occupying the property.

So you can see why so many commercial property investors would get involved in this asset class: the income is so reliable.

Income stability is one of the many reasons why we love commercial property. And why we think you might love it too.

How much have we lost our investors?

Zero. Nothing. Not a single dollar. Ever.

We’ve been in commercial real estate investment for years. We know it’s a secure, stable investment that produces a robust passive income and we know how to manage commercial assets better than most.

We believe in what we do. That’s also why we invest alongside our investors in every single commercial property opportunity we offer.

And we have never lost our investors a dollar. We have never seen negative yields and we have never seen a negative total return. We can’t guarantee our future results. But we can standby our past performance and prove that it was our expertise and our application of property fundamentals that helped us achieve them.

If you’re losing money on your existing investment, whether it be shares or residential property, consider a commercial property investment opportunity. It could put you on the path to a stress-free retirement. Just ask our investors:

Want more information on our investments? Get in touch with our investment relationships manager Guy Doggett.

Or subscribe to our monthly newsletter and be the first to know about our upcoming investment opportunities.

Properties & Pathways is a dynamic commercial property investment company. Our completed syndicates have provided investors an average annualised return of 19%. For more information on how you can invest alongside us, get in touch today. Past performance is not indicative of future returns. Any information provided in this blog post has not considered the objectives, financial situation or needs of any investor; investors should consider whether it is appropriate to them to partake in a commercial property investment prior to investing, in light of their objectives, financial situation or needs. Every investor should obtain and consider the investment’s Information Memorandum before making a decision in relation to the investment.

Properties & Pathways is a dynamic commercial property investment company. Our completed syndicates have provided investors an average annualised return of 19%. For more information on how you can invest alongside us, get in touch today. Past performance is not indicative of future returns. Any information provided in this blog post has not considered the objectives, financial situation or needs of any investor; investors should consider whether it is appropriate to them to partake in a commercial property investment prior to investing, in light of their objectives, financial situation or needs. Every investor should obtain and consider the investment’s Information Memorandum before making a decision in relation to the investment.