Economy

7 ways Trump’s presidency could impact the Australian property market

Published

28 January, 2025

Donald Trump. Even just saying the name sparks reactions, from enthusiasm to outright disdain.

But whether you’re a fan of his or not, one thing is certain: his last presidential term had a global impact. And if history is anything to go by, his polarising influence is set to ripple across international markets—including Australia’s real estate sector.

Let’s break down how Trump’s presidency could impact Australian property in the next few years.

1. The strength of the USD matters

You don’t need to read too much into Trump’s rhetoric to see his economic policies serve one primary purpose: domestic growth.

Tax cuts, deregulation and global tariffs boosted the US Dollar during his last term, and could do so again. And a stronger US Dollar generally makes Australian property more attractive to American investors, seeing as their purchasing power increases relative to the Aussie.

This might open the door for increased American investment in Australian commercial and residential property markets. But on the flip side, a strong USD often puts pressure on other global currencies—including the AUD—which could influence interest rates and inflation here at home.

2. Geopolitical tensions

A hallmark of Trump’s last presidency was his unorthodox approach to international relations: trade wars, volatile negotiations and a firm “America First” stance.

While some investors liked his boldness, these policies often created uncertainty in global markets. Uncertainty is rarely a friend to property markets, especially those reliant on foreign investment.

For Australia, geopolitical tensions can impact everything from the flow of international capital to the strength of our export markets, particularly with China (which we’ll discuss further).

Given Trump’s historically rocky relationship with Beijing, any return to power could reignite US-China tensions, potentially impacting Australia’s economy and, by extension, its property market.

3. Increased investment in Aussie safe haven

Trump’s presidency was often associated with political volatility in the US This led to many high-net-worth individuals and institutional investors looking to diversify their portfolios internationally, with Australia benefitting as a perceived safe haven.

If we see similar political turbulence, there’s a chance wealthy Americans and global investors will seek to park their money in more stable property markets, like Australia’s.

4. Interest rates and borrowing costs

Trump’s last presidency saw his administration pressure the Federal Reserve to keep interest rates low to (you guessed it) fuel economic growth.

Low US interest rates typically put downward pressure on global borrowing costs, which can trickle through to Australian cost of borrowing. And cheaper borrowing costs can of course stimulate both residential and commercial property markets.

Again, it’s important to look at the flipside. And in this case, Trump’s economic policies in his last term led to inflationary concerns, and central banks might react to that by tightening monetary policy more aggressively—something we’ve seen on our own shores since May 2022.

5. Migration and population growth

One of Trump’s defining (and most polarising) policies continues to be his strict stance on immigration. While this largely impacted the US last time round, it indirectly benefited countries like Australia, which offers a more welcoming environment for skilled migrants.

If the US were to become less attractive under Trump’s influence—and it seems it likely will—Australia might see increased demand from migrants, particularly high-income earners and professionals looking to settle in politically stable countries.

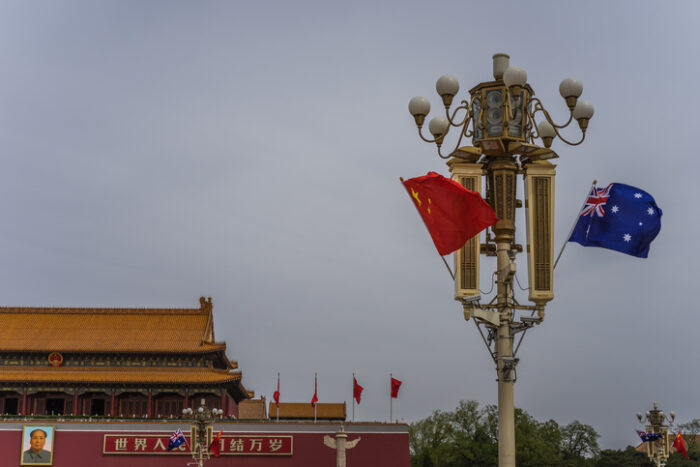

6. China’s role in Australian property

Trump loves tariffs, and his past aggressive trade policies against China reshaped global trade and influenced how China allocated its wealth globally.

Chinese buyers have been a huge force in the Australian property market, but economic and political shifts heavily dictate their buying appetite. If Trump’s policies or rhetoric were to escalate tensions with China, we might see reduced Chinese investment in Australian real estate.

Despite Chinese investment in Australian property falling by about 15 per cent in the 2024 financial year (the result of a slowing Chinese economy), they still remain the largest single nationality purchasing Australian real estate.

7. Divided (but resilient) investor sentiment

Trump’s leadership style has always been divisive. For some, his policies represent economic opportunity and a focus on business growth. For others, they signal unpredictability and risk. This division could spill into Australian investor sentiment, with right-leaning investors potentially viewing Trump’s policies as pro-business and left-leaning ones seeing them as destabilising.

Regardless of individual opinions, markets tend to adapt. Trump’s presidency taught us that even amid controversy and volatility, opportunities emerge. Investors who keep an eye on the bigger picture, rather than getting caught up in the drama, are often the ones who thrive.

Love him or loathe him

Whatever your thoughts on the man, Trump’s impact on the world economy cannot be ignored, and that includes its flow-on effects for Australia’s property market.

The key takeaway for us here at home is to stay informed and adaptable. Nothing changes the importance of evidence-backed information and key market indicators. So, keep an eye on US political shifts, consider the influences on your local property market and position yourself well to protect your investment or find a brilliant next opportunity.

Properties & Pathways is a leading commercial and residential property syndicator in Australia. Our priority is our investors, ensuring the highest quality investments and the most transparent communication.

Subscribe to our Investment Updates for exclusive alerts about our next property investment opportunities.