Commercial

Best Performing Supers lose to SMSF commercial property investment

Published

20 February, 2019

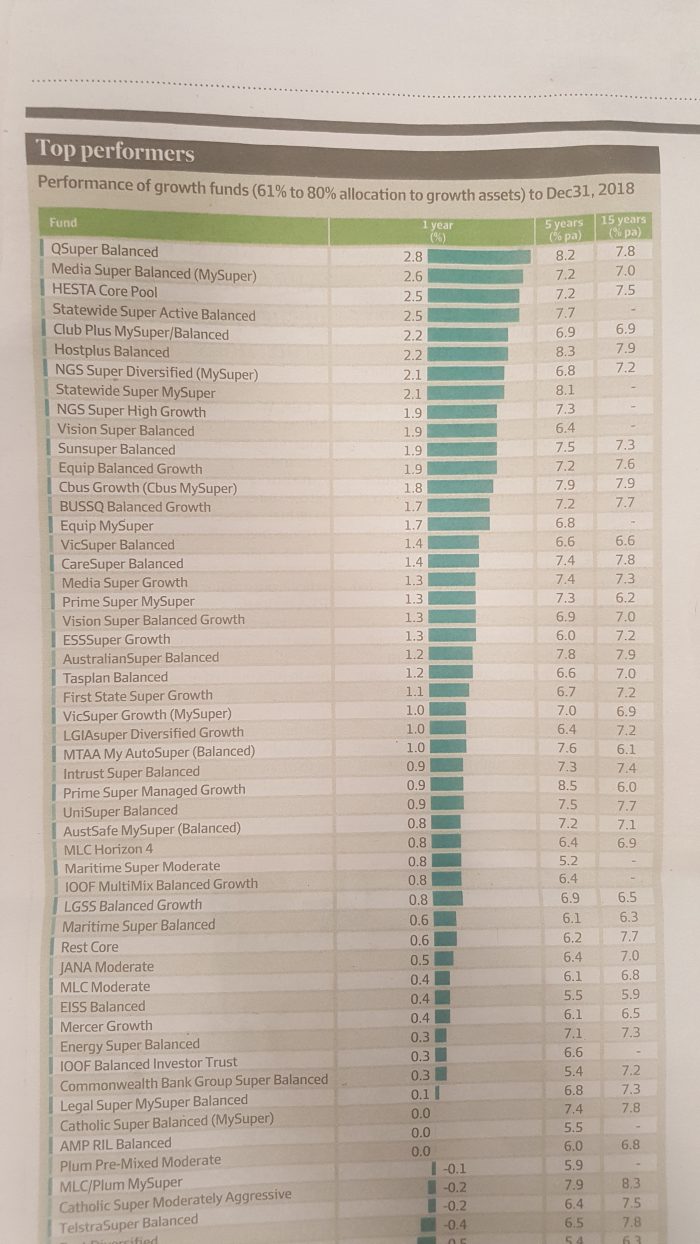

When the country’s best performing super funds were listed in the AFR’s Smart Investor on Saturday, 2 Feb 2019 – the funds which most Australians would be invested in – we expected to see notable annual returns.

On the contrary, the median growth fund returned 0.8 per cent in 2018 and the leading super fund brought in annual yields of 2.80 per cent (see image below) – comparable to the average term deposit or residential property. It seems Australian super funds haven’t yet learnt how to diversify their investments and move away from shares as their flagship investment. The best performing super funds in Australia lost out to SMSF commercial property investment (as we’ll soon show).

In our opinion, those preparing for, or already in, retirement are missing out on the growth they truly deserve. Here’s why:

Shares volatility

“Our members tell us protecting the value of their superannuation accounts from the worst effects of share market downturns is especially important to them,” says Brad Holzberger, CIO of market leading super fund QSuper.

Shares have copped many punches in recent years, with 2018 generating the lowest returns since 2011. Australian shares dropped 8.5 per cent in December 2018 and international shares slumped 13.5 per cent.

“Many superannuation funds perform well when share markets are strong but not necessarily when they’re down,” says Holzberger. When stocks go down, super fund members feel it.

So, what’s the solution for the majority of super fund members who want higher and more stable returns?

SMSF investment in commercial property

Ian Fryer, Chant West head of research, says the data of super fund returns “shows the benefit of its diversification into a wide range of unlisted assets. Diversification really is king.”

We couldn’t agree more.

Commercial property has typically given Properties & Pathways syndicates annual returns of 8 per cent and up (and an average internal rate of return of 15 per cent for completed syndicates). With the tax concessions involved, those placing commercial property in their SMSF are seeing even bigger benefits.

We’re seeing more investors use a self-managed super fund to take advantage of high commercial property returns. 8 per cent from a commercial property investment (excluding any capital growth) versus under 3.0 per cent yields – from a fund which is capsizing in the direction of the share market – seems like a simple victory for the former.

If you have a subscription to the AFR, you can read the full article here.

The information above in general in nature and is not intended to be considered advice. You are strongly encouraged to seek independent financial and tax advice prior to making a financial decision.

For more information on investing in commercial real estate, get in touch with Properties & Pathways today.