Insights

What will the extended border closure mean for WA’s property market?

Published

01 February, 2022

This week was set to be the first time in nearly two years WA’s hard border came down. February 5 was a date thousands of West Australians had circled on their calendar to see their loved ones and for east coasters maybe even to make a new home in the west.

Instead, we’re looking at weeks, months maybe, of continued isolation from the rest of the country as a front-footed Omicron variant forces Premier Mark McGowan to reconsider his border stance.

Non-West Australians are still blocked from entering the state, many of them property investors who were tipped to be the golden goose that would push Perth’s property market to boiling point. So, if they’re not coming… What now?

How was Perth’s reopening expected to impact real estate?

Perth property investors might be disappointed at the extended border closure. But 2022 is likely to be another year of growth for high-quality dwellings in the west.

The biggest impact the border closure will have on Perth property owners is disappointment.

Many expected large gains from the reopening, sparked by an influx of interstate migrants and those east coast investors wanting to inspect a more modestly priced asset in the west (remember, Perth’s median is several hundred thousand dollars less than Sydney and Melbourne).

The Real Estate Institute of WA (REIWA) president Damian Collins said increased demand from new arrivals and low stock levels would place upward pressure on prices, particularly in the second half of the year.

“WA has always been a state that has been driven by jobs and a strong economy and that’s what drives the population growth,” he said to the ABC in January.

“I expect once the borders come down, companies are certainly going to start ramping up their recruitment drives, both on the east coast and internationally.

“Now it will take some time to get those people recruited and on board, but I expect in the second half of 2022, we will certainly start to see a pick-up in population growth into Western Australia.”

REIWA has predicted prices were going to jump 10 per cent this year as a result of new arrivals.

Is Perth property still going to increase 10 per cent?

The ingredients are still on the table for Perth to have another year of growth in residential property.

Perth has a robust economic environment, with an unemployment rate at a record low, a mining industry swelling state government coffers, a skyline of cranes reflecting WA’s infrastructure boom, and an eventual border reopening on the cards (whether or not it’ll be before winter).

Subscribe to our Investment Updates

Want exclusive updates to our next investment opportunity?Complete the form below and we’ll email you as soon as our next residential property trust is around the corner!

Perth property’s affordability will continue to be a major appetitising factor for more investors vying for a place in the property market. Even an interest rate rise, speculated to come later in the year or early-2023, is unlikely to cool the market enough to see property values stagnate or even drop.

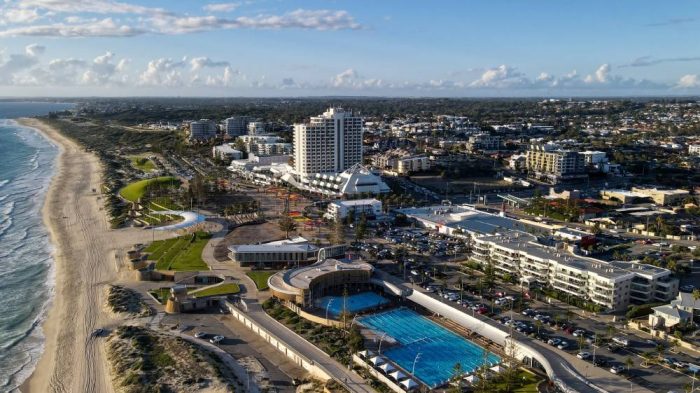

WA’s beachfront precinct of Scarborough saw 11.5 per cent annual growth in property prices last year, ten times its five-year average growth rate.

Property prices have climbed 22 per cent since late-2019, an increase Perth property owners had waited a decade for. Smartly purchased property in relevant locations are likely to do well in the year ahead, especially those larger parcels with investment potential.

Two other factors are leading the expert’s forecast for another year of growth in the west.

Supply can’t keep up with demand

There are currently 50,000 jobs required in Perth. And there are only 40,000 vacant dwellings. Demand has outstripped supply, and the pressure on the market will only continue when WA’s border opens to interstate migrants.

Long-term compound growth rate

WA’s current 10-year growth rate (a metric used to explain the capital growth of residential property over a given period) is sitting at 1.58 per cent. But its 20-year compound growth rate is forecasted at 6.33 per cent. Why does this matter? The long-term bias for growth is upwards. And dwelling demand will only heighten as a result of this. Capital values could skyrocket in the coming years.

Second chance for property investors to partake

Demand has outstripped supply, and the pressure on the market will only continue when WA’s border opens to interstate migrants.

The benefit of some Australians who are looking to capitalise on WA’s property market, with low interest rates on the cards for a while to come, is that the delay in the border reopening will perhaps delay the property price increases. This means many who are cautious about rising dwelling prices and being priced out of the market have another opportunity to partake.

Investors hoping the market will cool, and thus allow their casual entry into the property market, may be sore with regret if they watch property prices increase another 10-plus-per-cent in 2022 and 2023, and are forced to leave their cash in the bank for another property cycle (earning next to zero per cent interest).

Want to invest?

If you’re looking for a set and forget investment in Australian residential property, why not consider investing with a property fund? At Properties & Pathways, we offer a range of investment opportunities to sophisticated investors. Subscribe for investment updates or get in touch with our Director (Investor Relations) Guy Doggett today for exclusive information on our current investments.