About Us

Our Approach

During times of market uncertainty, so many things change. But our approach to property investment never does.

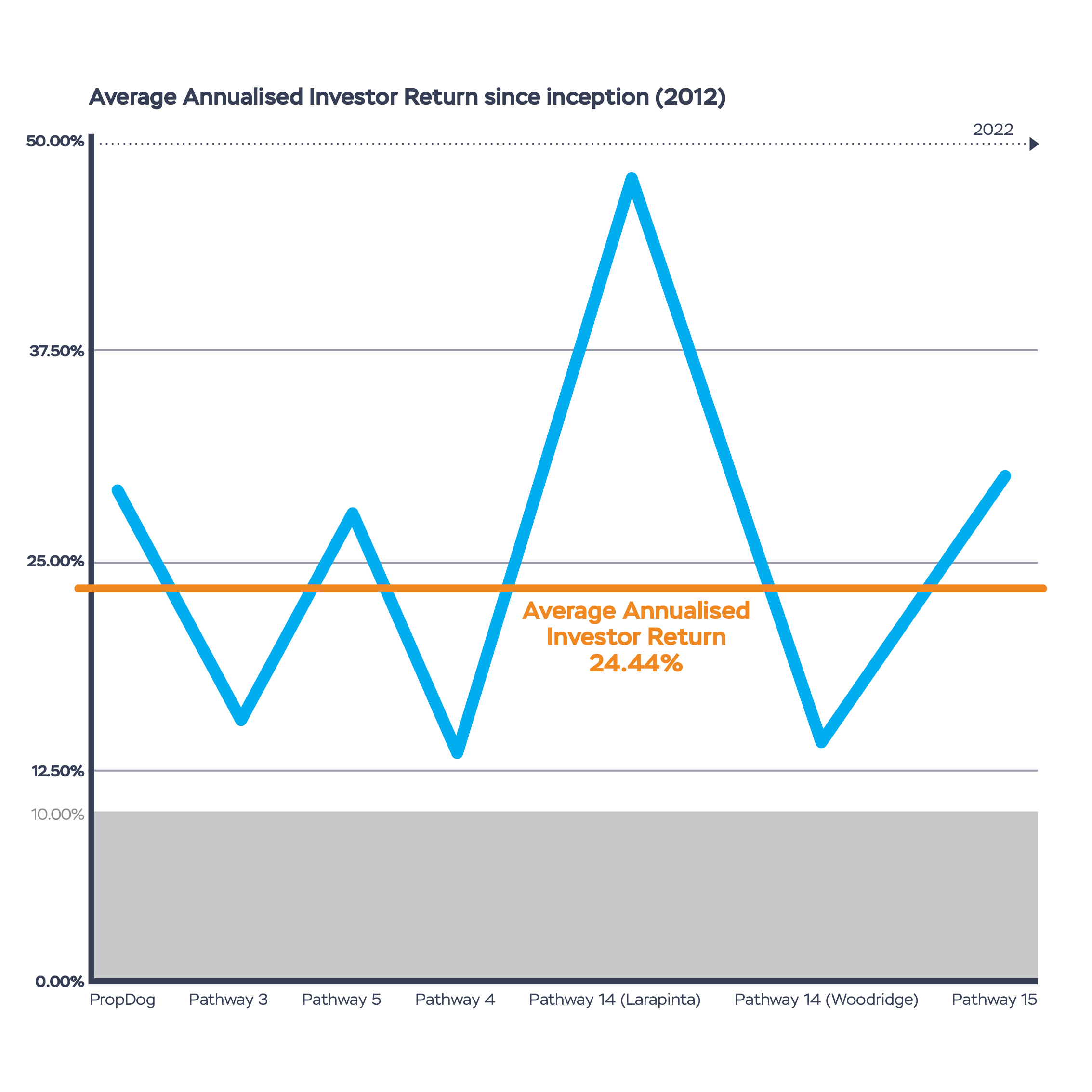

Track Record

Our approach is tried, tested, and produces an average annualised investor return of 24.44%. Our goal never changes: Locating an asset we are proud to offer to our investors.

Case Studies

Our results come from strategic, well-planned property investing. Want proof? Check out our case studies.

Insights

3 key drivers of the commercial real estate market

Updated: 21 August 2025 In commercial real estate, knowing the key market drivers is like seeing the road ahead when driving. These drivers – yields, business confidence, and occupancy rates – give investors valuable insight into where the property market is heading. Understanding these real estate trends in Australia can help both new and experienced […]

Insights

3 reasons Brisbane’s industrial property market is booming

You don’t have to look hard for good news on Brisbane’s industrial property market. Property values are headed skyward, investment sales in QLD are accounting for 32 per cent of the nation’s total (compared to only 18 per cent in 2018), and land rates are up by as much as 21 per cent over the […]

Insights

3 ways to achieve capital growth in commercial property

Many new commercial property investors forget that there is significant capital appreciation on offer during the lifetime of their investment. Sure, most investors (like us), pursue commercial real estate investments with passive income as the priority. But there is nothing quite like increasing – say, even doubling – your capital investment. But the question is, […]