Financial Planners

Certainty, comfort and prosperity. We want that for your clients, too.

Our goal is to create a long-term relationship with you and your clients, built on trust and transparency. We use professionally managed property syndicates to achieve that goal.

Why choose Properties & Pathways

We build wealth. Safely.

Why should your client invest with Properties & Pathways? Because we invest alongside every investor in high quality commercial property investments. While we provide a set-and-forget investment for our investors, we are proactive throughout the entire investment journey – from conducting an intensive due diligence investigation to divesting the asset with maximum possible upside.

Transparent communication

Each decision we make is communicated to every investor so that we can share the investment journey.

Diversification

We offer a range of single- and multi-asset property trusts, in addition to residential and commercial real estate investment

Fast onboarding

Our partners at Boardroom help provide a rapid onboarding process for your client, who will have 24/7 access to investment details.

A network of finance professionals

We work with dozens of referral partners across Australia. The quality of our investors match the quality of our investments.

Your client’s key to institutional-grade investments

By investing with us, your client can expect:

- A proven track record of results.

- Passive income from stable commercial property yields.

- Capital growth opportunities as a result of smart decision making and value-add investment strategies.

- Transparency and swift communication on all decisions related to your investment.

- Access to a network of property professionals all around Australia, and existing investor testimonials.

“We take an interest in every investment and share our expertise and rewards with each investor.”

Cal Doggett, Managing Director, Properties & Pathways

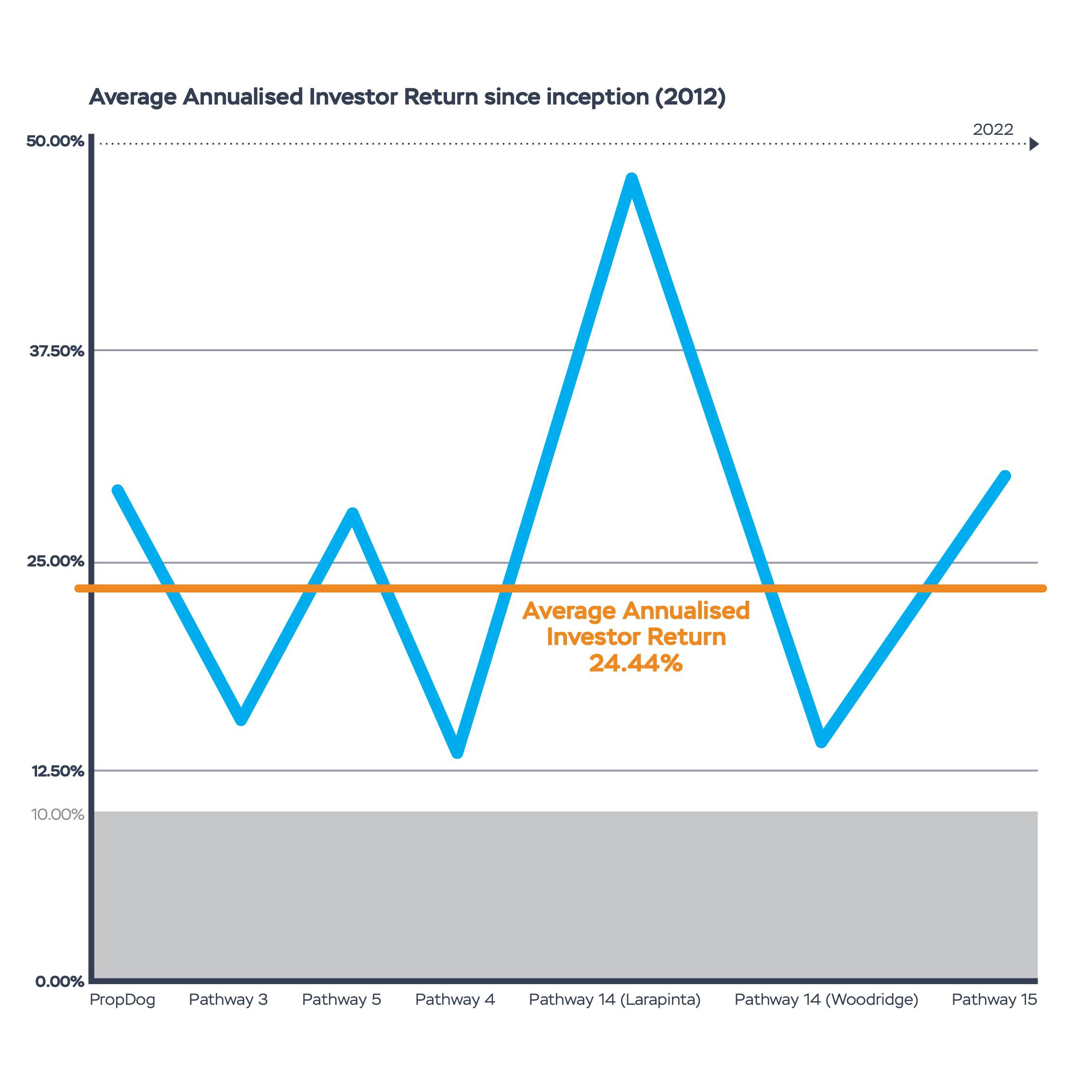

A track record of property success

We've spent years balancing risk and return, to develop investment strategies that achieve the best, safest and most profitable outcome for our investors. Because we're investors, too, and we know what makes an outstanding passive income investment.

Subscribe to our newsletter

The latest news, articles, and resources, sent to your inbox weekly.

Past performance is not indicative of future returns. Any information provided on this website has not considered the objectives, financial situation or needs of any investor; investors should consider whether it is appropriate to them to partake in a commercial property investment prior to investing, in light of their objectives, financial situation or needs. Every investor should obtain and consider the investment’s Information Memorandum before making a decision in relation to the investment.