Insights

Why net effective rent is the first calculation property investors should make

Published

06 November, 2024

No matter what type of commercial real estate you’re investing in, knowing the net effective rent can provide a clear picture of an investment’s potential returns over the term of the lease.

Property investment is a numbers game, and even if maths wasn’t your favourite subject in school, it’ll become your most valuable tool when putting together a successful property investment.

Today, we’ll break down why net effective rent should be your starting point and explain how it helps uncover the true profitability of a property.

What is net effective rent?

Net effective rent is the average rent a tenant pays over the course of a lease, accounting for all lease incentives like rent-free periods, fit-out contributions and other concessions.

Unlike gross rent (the full amount paid without any deductions), net effective rent gives a more accurate reflection of a property’s profitability by factoring in any incentives that reduce the tenant’s actual payments.

Similar to a handicap on the golf course, as a way to compare to unevenly matched golfers, you need a way to compare two properties that seemingly have far different attributes. And it’s net effective rent is the handy metric that allows investors to compare properties more accurately and make informed decisions about which investments offer the best long-term returns.

Why is net effective rent so important for investors?

1. Transparency on real income

Net effective rent provides clarity on the real income a property generates. Imagine you’re considering an office building with a high advertised gross rent, but the landlord has offered the tenant a six-month rent-free period at the commencement of the lease. By calculating the net effective rent, you can spread that incentive over the lease term to find out what the tenant is truly paying on average per year.

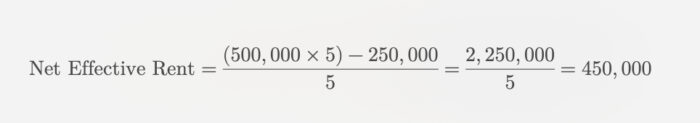

For example, let’s say an office space is rented at a gross rate of $500,000 per year over a five-year lease. But the landlord offers a six-month rent-free period, effectively reducing the first year’s income by $250,000. The net effective rent is calculated as:

So, in this case, $450,000 is the true annual income from the lease, giving a more accurate measure of return compared to the gross rent of $500,000.

2. Reliable comparison between properties

Commercial property leases often come with various incentives to attract tenants, especially in competitive markets. Two similar properties with the same gross rent may have different net effective rents due to these incentives.

By comparing net effective rents, you gain a true side-by-side comparison, which makes life far easier to determine which property will generate better cash flow over time.

Check out another example:

- Property A: Gross rent of $300,000 per year with no incentives.

- Property B: Gross rent of $300,000 per year, but with a fit-out contribution worth $150,000.

Even though both properties appear to have the same gross rent, Property B’s net effective rent will be lower, as the fit-out contribution is an added expense for the landlord. Investors who consider net effective rent can clearly see that Property A will yield higher income without additional outlay.

3. Accurate cash flow forecasting

Cash flow is king for commercial investors, and the net effective rent gives a more accurate forecast of cash flow over the lease term. This helps investors understand whether a property aligns with their cash flow needs and long-term financial goals.

In a situation where a landlord grants periodic rent-free periods or covers certain operating expenses, calculating net effective rent will help investors avoid surprises. It’s not uncommon for incentives to make a property seem more profitable than it really is. Net effective rent smooths out these fluctuations, providing a clearer picture of ongoing cash flow.

How to calculate net effective rent

While calculating net effective rent might sound complex, it can be simplified:

- Identify the gross rent: The full rent the tenant is paying without deductions.

- Subtract incentives: Sum up all incentives like rent-free periods, contributions for tenant improvements or cash incentives.

- Divide over lease term: Spread this adjusted amount over the full lease term to find the net effective rent.

For example, if a retail property has a gross rent of $400,000 per year on a five-year lease, and the landlord offers $100,000 in incentives upfront, the calculation would be:

Here, the net effective rent is $380,000 annually, giving a clearer understanding of the property’s true income potential.

Making smarter investment decisions with net effective rent

For Australian commercial property investors, net effective rent isn’t just a number on paper—it’s a tool that informs every stage of the investment process, from the initial purchase decision to long-term portfolio management. By calculating net effective rent upfront, investors can:

- Identify value: Spot properties that offer stable, reliable cash flow without costly incentives that drain profitability.

- Negotiate better deals: Understand the financial impact of incentives and negotiate terms that boost net effective rent.

- Forecast with confidence: Build cash flow projections on a solid foundation, reducing the risk of unexpected income shortfalls.

When buying or leasing a commercial property, always start with the net effective rent calculation. By understanding how much income the property will truly generate, you’re better equipped to make informed decisions, optimise returns and find success in the commercial property market.

Want more handy investment info like this? Subscribe to our monthly newsletter and we’ll deliver expert written news and views direct to your inbox.