Insights

Why Perth’s residential market will lead the nation until at least 2026

Published

12 March, 2024

Perth’s housing market is leading the nation, and predictions are for this buoyancy to continue—perhaps until at least 2026.

Even after thirteen consecutive interest rate rises, Perth’s median housing growth hit 15 per cent in 2023. The market is tipped to exceed 10 per cent growth in 2024, and even 2025 could see double-digit gains. Indeed, the ingredients for serious continued growth in the already heated Perth residential market are being stirred into the pot.

Accurately predicting the future of a housing market can be tough—but the job is less formidable with the right data. So, let’s see why Perth’s housing market will likely lead the nation in value growth until at least 2026.

Why Perth’s housing market will continue to outperform

Population growth

Perth is the fastest growing major city in Australia. As at June 2023, WA’s growth rate was 3.1 per cent, with its population increasing by 86,800 people. Interstate and international migration to WA has skyrocketed and continues to dwarfs the national growth rate figure of 0.7 per cent (as at June 2023).

It’s not hard to see why: the lifestyle, the weather and the endless things to do in Perth are a magnet for interstate and international arrivals.

So, how does population growth influence property prices?

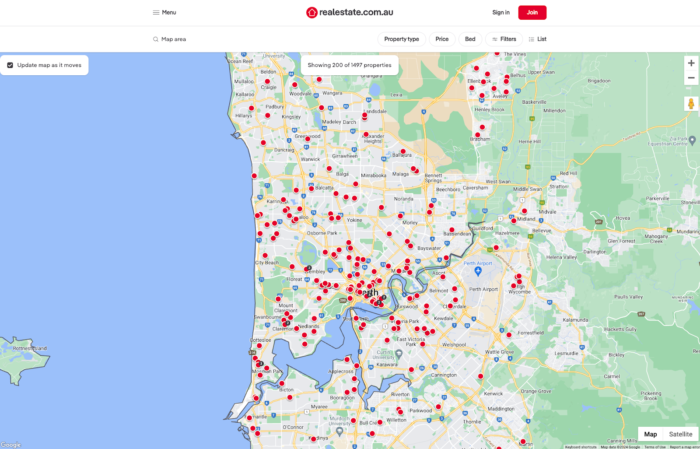

A higher population represents a higher collective need for dwellings to live. This of course fuels demand in both the rental and homeowner market. And if you’ve been on either REIWA.com.au or realestate.com.au lately, you’ll know there are very few options for either renters or homeowners to find their next (or their first) place to live in WA.

Supply constraints

WA is in the middle of a housing crisis, unable to support the population’s demand for roofs over heads. And the influx of arrivals in WA does not help the shortage of established homes and apartments.

Within 15 kilometres of the Perth CBD, there are less than 6,000 properties for sale and only around 1,500 properties for rent.

These supply constraints also make existing homeowners reluctant to sell. Because, if they were to, they’d have very few options to relocate.

Supply is a lagging fundamental. It responds to demand, which responds to population growth (and wages growth—which has increased in WA).

So, what could drastically increase supply in the short-term?

Nothing. There’s a long lag in new buildings because profit margins are too low for developers to consider major projects viable. If you’re a developer, why would you spend 18 months building a property if it provided zero net gain? You’d be smarter to hold your portfolio of land assets and watch value increases until such projects make sense.

And despite some local councils reducing the red tape of subdivisions and construction—through rezoning and the like—it will still take a lot of time for those benefits to be realised. After all, once rezoned, subdivision approvals still take months and construction takes many more.

In the long-term, we expect prices to reach a level where buyers will turn their attention to more affordable residential acquisitions: land.

Higher density regions are an obvious likelihood for Perth’s metro areas, with shared housing and apartment living being alternative but viable options for those looking for a home.

And even when this eventuates, housing in Perth will still be a far cheaper option than either Sydney or Melbourne dwellings.

Affordability (compared to the east coast)

Even if Perth’s median were to double, its property market would still be far more affordable than the east coast. Only 33 per cent of WA owner occupiers’ salaries go towards servicing a mortgage—that same figure is 87 per cent in New South Wales.

Despite the difficulties of finding a home to purchase in Perth, the Affordability Index (AI; which compares the relationship of annual mortgage interest costs to annual household income) shows that the median Perth rent accounts for 35 per cent of household income whereas mortgage affordability accounts for only 29 per cent.

In other words, it’s more expensive for the average household to rent a home than own one. And until rental and mortgage affordability intersect (something which is far down the line), this will likely remain the case.

Long-term growth rate

For the number lovers, the data shows us that the long-term compound growth rate in Perth is far outpacing the 10, 7, 5 and 3-year growth rate.

Long-term (since 1980): 7.16%

Last 10 years: 1.54%

Last 7 years: 1.38%

Last 5 years: 2.55%

Last 3 years: 6.72%

To meet the long-term growth rate of 7.16 per cent, the current growth rate would need to achieve over 11 per cent per year over the next four years. In simple terms, the Perth market could achieve consistent 11 per cent growth per year for the next four years and still not meet the rolling long-term average.

More rate cuts, more price growth

Property prices in Perth have proved considerably resilient to interest rate increases. While rent is still considerably more expensive than mortgage repayments, this “high interest rate environment” can easily be absorbed by households in the west.

So, if interest rates fall—which experts believe will occur in 2024—then even more people will be open to purchasing rather than renting.

And what would this do to the market? Our advisors tell us that two 25-basis point interest rate cysts could result in between 10 per cent and thirty per cent growth in Perth.

Putting our money where our nous is

We’ve put our money where our mouth is—or more accurately, our money where our nous is. In 2024, we launched the P&P Capital Growth Fund Two, an investment opportunity that aims to deliver serious capital gains from 8 targeted residential properties in WA.

Click here to see if Units still remain or subscribe for investment updates today. We’ll let you know as soon as our next opportunity is around the corner.