Commercial

6 tips before selling a commercial property

Published

23 January, 2020

The choice to sell a commercial asset shouldn’t be taken lightly. After all, commercial real estate can be a fruitful investment providing stable cash flow. But perhaps an offer has been dropped on the table or another investment opportunity has you licking your lips… Either way, you need to be prepared before selling a commercial property.

The sale of commercial real estate is not as simple as getting rid of a residential property or a bunch of shares. It takes time and consideration to offload such a big asset.

6 tips before selling a commercial property

- Considering your tax obligations

- Factoring in property sales costs

- Understanding the current value of your commercial property

- Ensuring your tenancies and lease agreements are in order

- Owning a property that is worthwhile selling

- Getting your team ready for the sale

Let’s take a closer look at how you should prepare for the big sales event.

1. Mitigate capital gains tax

The Australian Tax Office rewards good property investing with capital gains tax (CGT).

It’s a prize no one wants to claim. But CGT can be mitigated.

Firstly, try proving your investment has a high cost base. The higher the cost base (i.e. purchase price plus all expenses) the less the net capital gain (i.e. difference between property’s cost base and sales price). And the less net capital gain, the less tax you’ll pay on it.

So, keep receipts and records of all deductible expenses. Any improvements and upgrades made to the property could be deductible and added to the investment’s overall cost base.

Also, ensure your depreciation schedule is kept in order. Depreciation is Australia’s gift to property investors and can act as a value-add opportunity. We’ve literally saved millions of dollars thanks to it.

And finally, ensure you know how CGT can be discounted. For properties held for more than 12 months, the levy can be reduced using one of three methods set out by the ATO. You’ll find them listed in our blog post What capital gains tax means for commercial property.

2. Factor in the costs

It costs money to sell a commercial property. Include these costs in your sales modelling, so you’re not left with any surprises.

This will include (but not be limited to):

- Legal fees

- Advertising costs

- Commission to agents

- Break costs paid to the bank (if a fixed term loan is paid out early)

3. Know your commercial property value

You’ll only know what sales figure to expect when you know what your property is worth. You’ll need this number to stand by your minimum offer amount during negotiations.

4. Check your tenancy schedule

A buyer will want guarantee that the property’s income will be coming through the door today and tomorrow. So, your commercial property’s remaining lease terms should be long. We’re talking at least two years.

If not, you have two options: Begin negotiations with your tenants to extend their lease term. Or establish the tenants’ willingness to stay in the property early. This way you can give buyers confidence that the investment’s cash flow is likely to continue.

Sure, some commercial property investors like to add value by extending lease terms after they buy (we do it all the time – check out our investment archives). But most investors want to enjoy a set and forget investment, with guaranteed cash flow. So, it’s wise to offload your property with all t’s and i’s crossed and dotted.

5. Buy well

When you do things right from the start, your job at day’s end will be much easier. So, ensure your property is saleable by buying well. This means finding a stable asset, with solid fundamentals, in a core location.

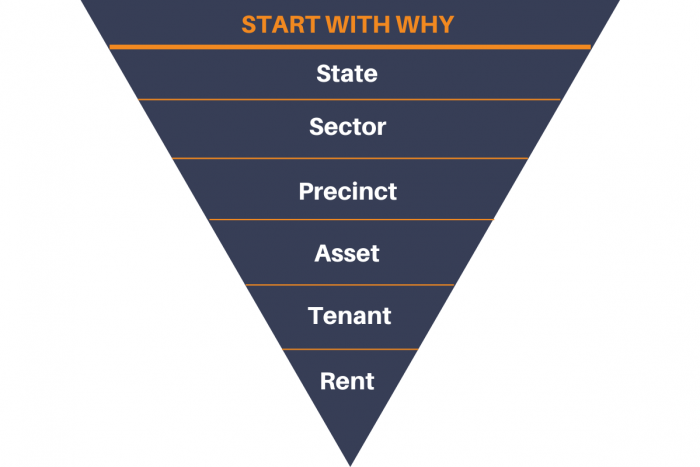

At Properties & Pathways, we have a simple strategy to buy commercial property. Start with WHY.

It’s a top-down approach using an inverted pyramid. From top – where we ask which is our favourite Australian state – to bottom – where we ask what rent we should expect from our chosen property.

If you invest with us, all you’ll ever see us doing is asking, “WHY?” That’s what we base every decision on and why we’ve delivered over $20 million for our investors in just a few years.

6. Ensure your team is ready

Your accountant, legal adviser, financier and investment partners should be ready at the helm. Ideally, engage these parties early in or before the sales campaign.

Your accountant will help with mitigating capital gains tax and your legal adviser should ensure you have the correct sales documentation in place when you part with your asset.

The bank will need to discharge the mortgage once settlement is completed, so advise them early of your intentions to divest.

And anyone who has invested alongside you will want to know the sales strategy, who the potential buyers are and (the obvious) how much they’ll receive after the property sale.

It takes time and experience to know how to sell well. But the rewards can last you years. Commercial real estate is more known for its yields than it is its potential for capital gains. But we’ve found that investing with solid fundamentals and divesting with a solid plan can provide huge total returns.

If you’re new to investing, the steps to selling a commercial property might be overwhelming. We get it: There’s plenty to consider when selling a commercial asset. And this blog post barely scratches the surface.

For more information on what to expect when investing in commercial property, get in touch with us.