Commercial

Want to buy commercial property? Here’s how

Published

10 December, 2019

Buying commercial property means having a strategy. You need to understand the location – whether buying in Perth, Sydney or Melbourne – and the commercial sector you’re buying in – industrial, retail or office. Just as important, you’ll need to get a feel for the tenant occupying the premises and of course the asset itself.

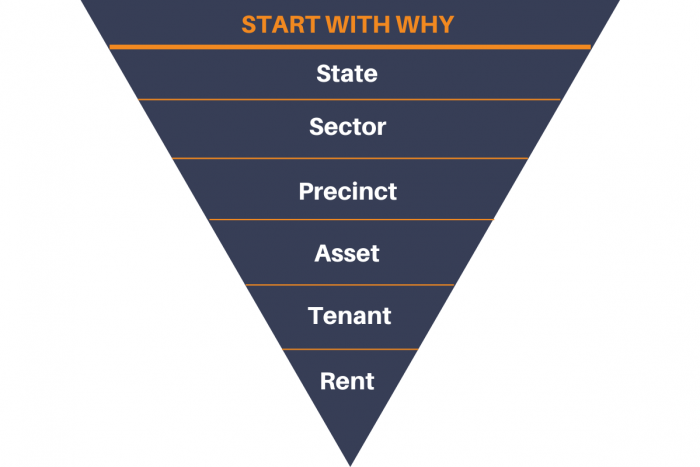

At Properties & Pathways, we’ve been investing in big league commercial property for decades. Our approach to buying commercial property? Start with “Why?”

Investing in commercial property “from the top down”

So, what does that mean: ‘start with “Why?”’ You want cash flow and you want capital growth… We get it.

But strong cash flow and robust profits only come when you ask WHY you’re buying in that location and WHY you’re buying that commercial property.

Our pyramid below sets out our commercial property buying strategy. From top – where we ask which is our favourite Australian state – to bottom – where we ask what rent we should expect from our chosen property.

Let’s dive in.

#1 Why invest in commercial property in this state?

First, understand which state you should buy in. And you’ll find this out by understanding how each state economies are performing.

Is an economy booming but likely to soon bust? Has a state spent years in a downturn, but signs are showing things turning around?

Investors have avoided WA for years. Property values plummeted after the peak of the last mining boom in 2012. But figures now show green shoots emerging, with commercial property rents finally stabilising over the last two quarters of 2019. This is a result of renewed investment in the mining sector, jobs growth and a strengthening state economy. This is a great place to look for a counter-cyclical investment.

#2 Why invest in industrial, office or retail property sectors?

After you understand which state you want to invest in, the next stage of your strategy is understanding which sector (also known as asset class) your money will be best invested.

The three major sectors are industrial property, office property and retail property. Research how each sector is performing in your targeted state.

Some states might have a strong industrial market, perhaps propped up by logistics centres looking for space, or by industrial businesses receiving work from new mining or infrastructure projects. Office properties may have strong leasing demand, thanks to population and jobs growth. Or maybe retail is the way to go, if the state has a population with money to burn.

There are many factors to consider beyond these.

We typically in sectors that have declined or hit rock bottom. So, for example, if office property values have spent years in the doldrums but are now showing signs of improvement, we want to know about it.

#3 Why invest in this precinct?

Do we want to buy office property in Ballajura, or do we want to buy office property in West Perth?

Every precinct has its own quirks and reason for investing. Some have great access to major arteries and many pockets will have high quality neighbours which will help your potential tenant’s business.

If I’m a customer looking to refurbish my living room, I’ll be headed to your precinct if I know your tenant’s furniture store neighbours JB Hi-Fi.

Investors should understand what the local markets are doing. Some tenants will look to higher quality premises when vacancy rates are up. This is called a “flight to quality.”

The key is to research where the local precinct is positioned in the property cycle now, and where it’s likely to be in the next few years.

When vacancies are high in a state because of low tenancy demand, many tenants will upgrade to higher quality premises at a cheaper price. This is called a “flight to quality.”

So, typically the first precincts that will see value growth during a downturn are the hotter parts of town. It’s just one of the many considerations to make when asking WHY you’re investing in this precinct.

#4 Why invest in this asset?

If you’re going to buy an office property in West Perth, what does that asset look like?

Do you want it to be a small 200sqm premises or a larger 1,000sqm asset? You can answer this by researching the leasing and tenant demand for that precinct and sector.

So, you find out the leasing and tenant demand is currently for 1,000 square plates. Simple. You now know what you’re looking for and why: Assets with 1,000 sqm plates so you can maintain your tenancy.

#5 Why will our tenants want to stay in this property?

Listen, listen, listen to your tenants. If you ask what they need, they will not only tell you every niggle about the premises, they will be loyal to you for their entire tenancy.

Why do they have a problem with the parking? Because the neighbouring tenant’s signage is making accessibility difficult. Well, let’s move that signage away from the carpark.

Listening to your tenants is key in commercial property investment. Solve their problems early and you’ll have a long-term loyal tenant.

Why don’t they use the communal bathroom? Because it’s ghastly and in need of a facelift. So, let’s consider an upgrade.

So, create or mould your property to one that your tenants won’t want to move out from.

#6 What is the rent we can expect – and why?

You want to find out what rent is reasonable to project and reasonable to expect for the property you’ve chosen. If your expectations on the rental are higher than what reality delivers, then you’ll want to ask, why?

It may mean adjusting your forecasting or reconsidering what is happening in the market.

If you invest with us, all you’ll ever see us doing is asking, “WHY?” That’s what we base every decision on and why we’ve delivered over $20 million for our investors in just a few years.

For more information on how to invest alongside professionals in a commercial property syndicate, get in touch with us today.